Last Updated on June 20, 2025.

Looking for clarity on tariffs and trade?

This page is your go-to hub for everything your business needs to navigate Canada-U.S. tariffs, CUSMA compliance, supply chain adjustments, and available support. Whether you're just getting started or adapting to new changes, the resources here will guide you every step of the way.

Tariffs Currently in Effect

Latest from Invest Surrey

Webinar: Supporting Businesses in Uncertain Times

Watch this recorded session hosted by Invest Surrey and City of Coquitlam, offering insights and practical support for businesses navigating ongoing trade uncertainty and US tariffs. Learn about available relief programs from Export Development Canada (EDC) and Business Development Bank of Canada (BDC), and hear directly from senior advisors on how to adapt and grow in today’s climate.

Your Guide to Tariffs and Product Codes

You can use the Canada Tariff Finder to look up tariffs on products you want to import or export. The tool shows both regular and special rates, lets you compare up to three countries or products, and makes it easy to search, print, or email the results.

the Government of Canada is putting a 25% tariff on $30 billion worth of goods coming from the United States. These tariffs only apply to products that are officially marked as made in the U.S. Find out which products are affected here.

Tariffs and tariff codes have been around for centuries, but they’re especially important to understand right now with new worldwide tariffs. This article will help you understand what tariffs and tariff codes are, the different types, and how to read them clearly.

Qualify for Tariff-Free Trade Under CUSMA

of Canadian exports to the US should be able to cross the border duty free under CUSMA

of Canadian exports to the US are likely compliant with CUSMA rules of origin

of exports from Canada to the US were CUSMA compliant in March 2025.

Diversify Your Supply Chain

You can use the The Canadian Importers Database to get summary reports and lists of companies importing goods into Canada. Use this tool to find companies by city, country or products.

A free, searchable database of BC food and beverage products connecting retail, wholesale, and foodservice buyers to BC food producers and processors.

Find the right BC wood supplier for your next project.

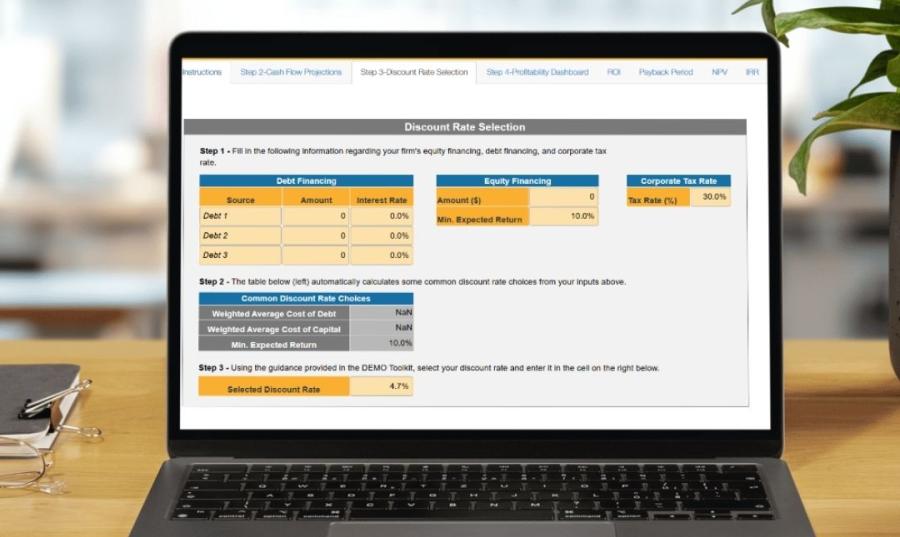

Unsure About a New Supplier? Use the DEMO Toolkit to Evaluate Profitability

Explore the Toolkit

More Information

Business Grants and Support

- Government programs for businesses impacted by U.S. tariffs

- BDC's Pivot to Grow Loan

- Export Development Canada (EDC)'s Tariff Impact Program

International Trade

- Canada's support for international investors facing U.S. trade barriers

- Official sources for Canada's trade rules and tariff regulations

- Strengthening and evaluating supply chains to reduce trade risk

Provincial and Regional Responses

- B.C.’s actions to support local industries affected by tariffs

- Regional resources and support for businesses facing tariffs

- Surrey’s leadership efforts to protect regional businesses

- Local tools and information for Surrey businesses affected by tariffs